how are 457 withdrawals taxed

However distributions from a ROTH 457 plan are not subject to tax withholding. Withdrawals from 457 retirement plans are taxed as ordinary income.

How To Access Retirement Funds Early Retirement Fund Investing For Retirement Early Retirement

Regular income tax still applies to.

. The type of Plan you have 401k or 457. However an individual who although eligible does not defer any compensation under the 457 plan in any. Theres a good reason for that Durand says.

You will still however need to. The IRS doesnt impose a 10 early withdrawal penalty on withdrawals made before age 59 ½ if you retire or take a hardship distribution. Under the Internal Revenue Code you can take money from a 457 early without paying the 10-percent early withdrawal penalty but youll still have to pay taxes on the money.

Use this calculator to see what your net. When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 plan. Rollovers to other eligible retirement plans 401 k 403 b governmental 457 b.

Basically any amount you withdraw from your 401k account has taxes withheld at 20 and if youre under. Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. What are the tax benefits of a 457 plan.

Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. There isnt an additional 10 early withdrawal tax although withdrawals are subject to ordinary. All distributions from IRAs 401ks 403bs and 457 accounts are subject to income taxes at ordinary income tax rates except Roth accounts.

Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. Also 457 plan participants are permitted to. Distributions to a participant from a tax-exempt employers 457b plan are wages under 3401a that are subject to income tax withholding in accordance with the income tax.

Withdrawals from 457 retirement plans are taxed as ordinary income. 457b plans of tax-exempt employers to section 457b6 of the Code and therefore still requires that they be unfunded. 457 Plan Withdrawal Calculator.

However distributions from a ROTH 457 plan are not subject to tax withholding. With a 457 retirement savings plan. Eligible section 457 plan are taxable currently under section 457.

Early distributions those before age 59 12 from 457 b plans are not subject to the 10 percent penalty that 401 k plans are. So if you need to tap into your 457b contributions before you reach age 595 and youve left the job that provided you with the 457b dont fret. Withdrawals from 457 retirement plans are taxed as ordinary income.

For this calculation we assume that all contributions to the retirement account. Withdrawals are subject to income tax. Section 2D of this article provides a complete.

Your age and employment status. Required minimum distributions under Internal Revenue Code Section 401 a 9 Yes. Once you retire or if you leave your job before retirement you can withdraw part or all of the funds in your 457 b plan.

Unlike other tax-deferred retirement plans such as IRAs or. However distributions from a ROTH 457 plan are not subject to tax withholding. Also 457 plan participants are.

All money you take out of the account is taxable as ordinary income in. The amount you wish to withdraw from your qualified retirement plan. 5 457b Distribution Request form 1 Page 3 Federal tax law requires that most distributions from governmental 457b plans that are not.

How much tax do you pay on a 457 withdrawal.

Can I Max Out My 401k And 457 Here S How It Works

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

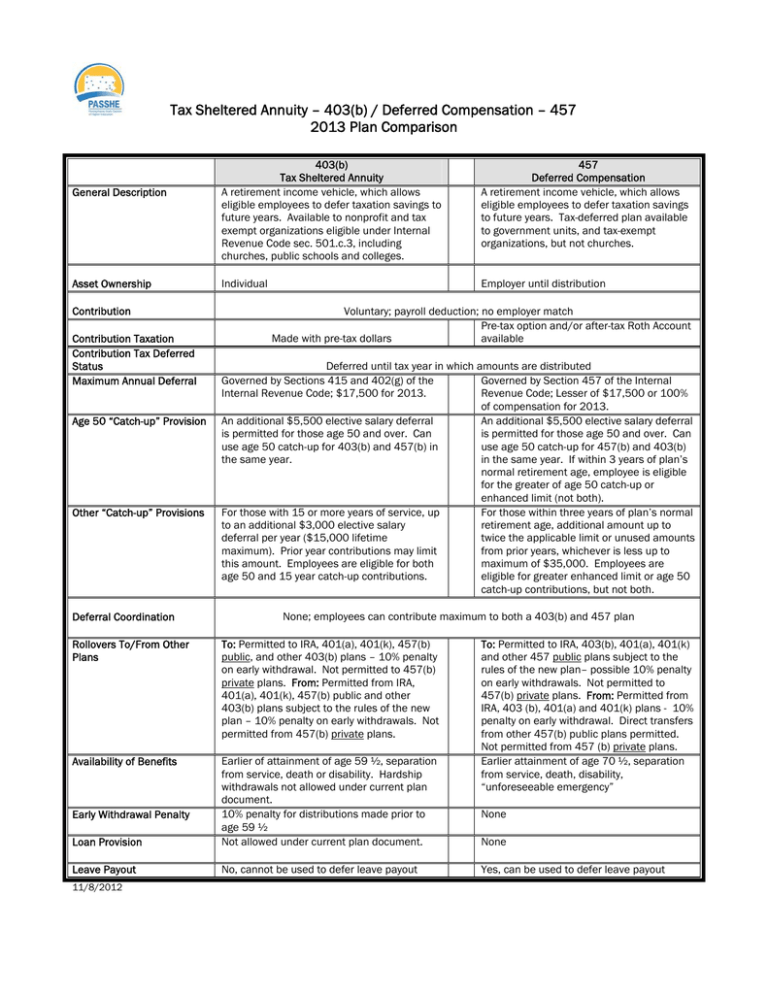

Tax Sheltered Annuity 403 B Deferred Compensation 457

457 Plan Types Of 457 Plan Advantages And Disadvantages

How 403 B And 457 Plans Work Together David Waldrop Cfp

Retirement Income Calculator Faq

How A 457 Plan Works After Retirement

Everything You Need To Know About A 457 Real World Made Easy

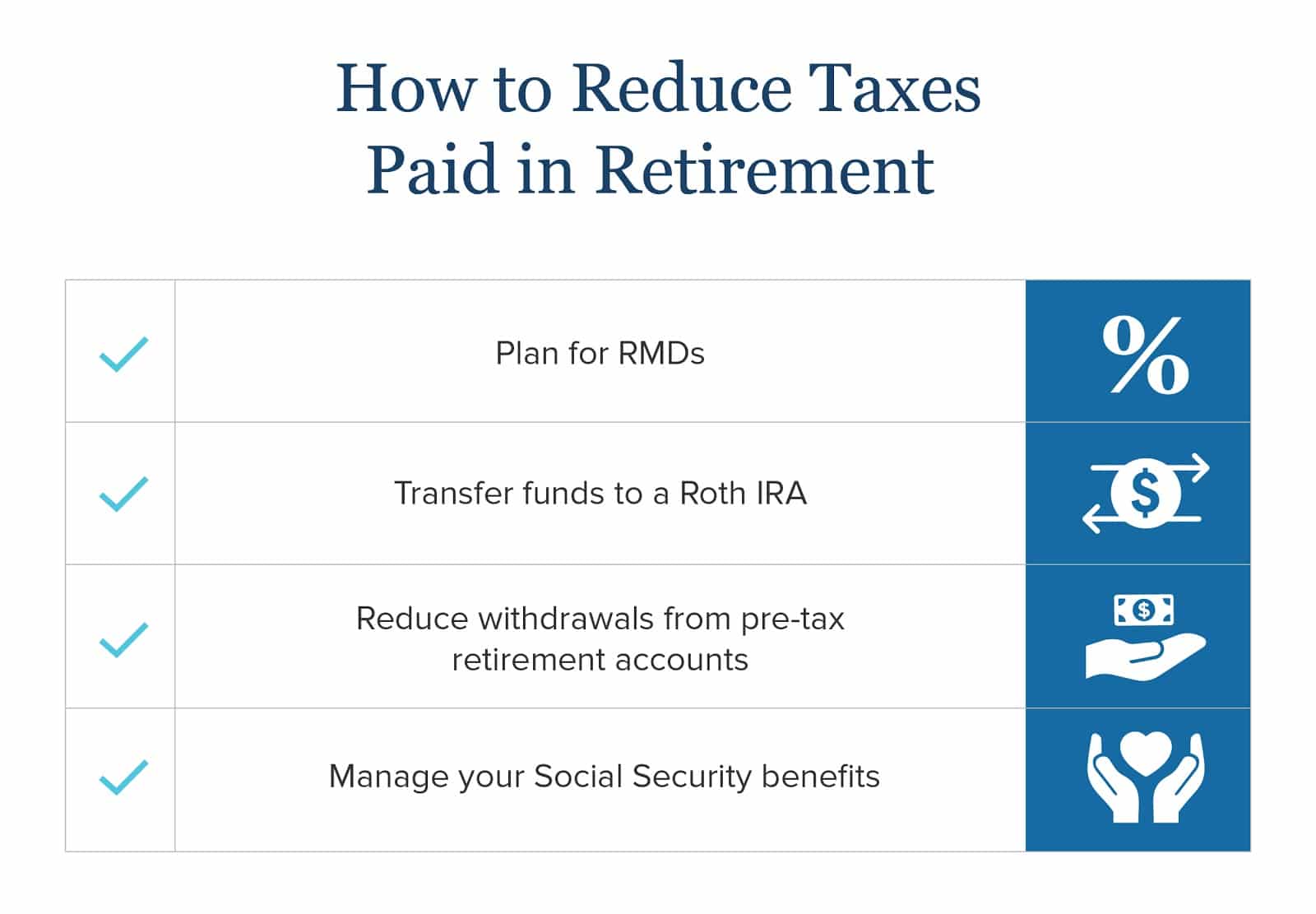

How To Plan For Taxes In Retirement Goodlife Home Loans

The Hierarchy Of Tax Preferenced Savings Vehicles

Sec 457 F Plans Get Helpful Guidance Journal Of Accountancy

Using A 457b Plan Advantages Disadvantages

/AP_401146136212-600579d89b014f62b098ed5ab375a3fc.jpg)

Are 457 Plan Withdrawals Taxable

Pin By Kimberlee Erickson Daugherty On Financial Freedom Money Today Traditional Ira Financial Freedom

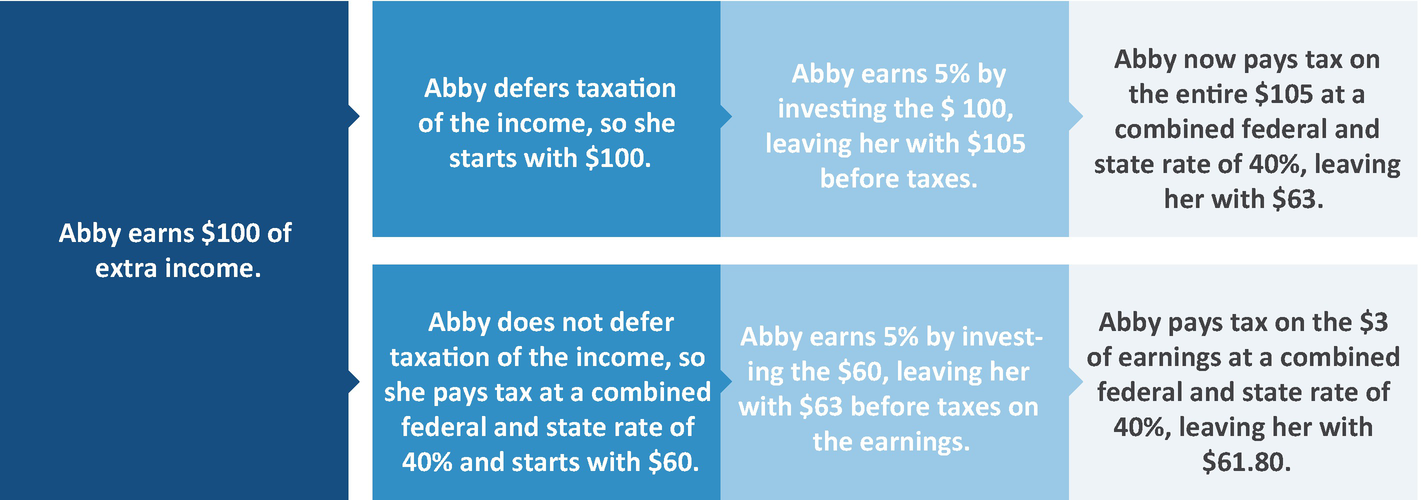

Tax Deferral How Do Tax Deferred Products Work